The power of Unsecured Bank Guarantee

Want a financial ally that guarantees security and fuels growth simultaneously? Unsecured Bank Guarantee services are the answer!

An Unsecured Bank Guarantee is a powerful instrument that offers businesses the flexibility to navigate complex transactions and foster financial expansion. Let’s delve into the dynamics of Unsecured BGs, understanding their role in unlocking financial growth for businesses.

Understanding Unsecured Bank Guarantee

An Unsecured Bank Guarantee is a financial commitment issued by a bank to a beneficiary (typically a seller or service provider) on behalf of an applicant (buyer or service recipient). What sets it apart is the absence of collateral, making it a versatile and accessible option for businesses. This financial tool acts as a promise from the issuing bank to honor the financial obligations of the applicant in case of default.

Note: While unsecured guarantees do not require specific collateral, some banks may still request certain security or assets to mitigate risks. This could include a general lien on assets or personal guarantees.

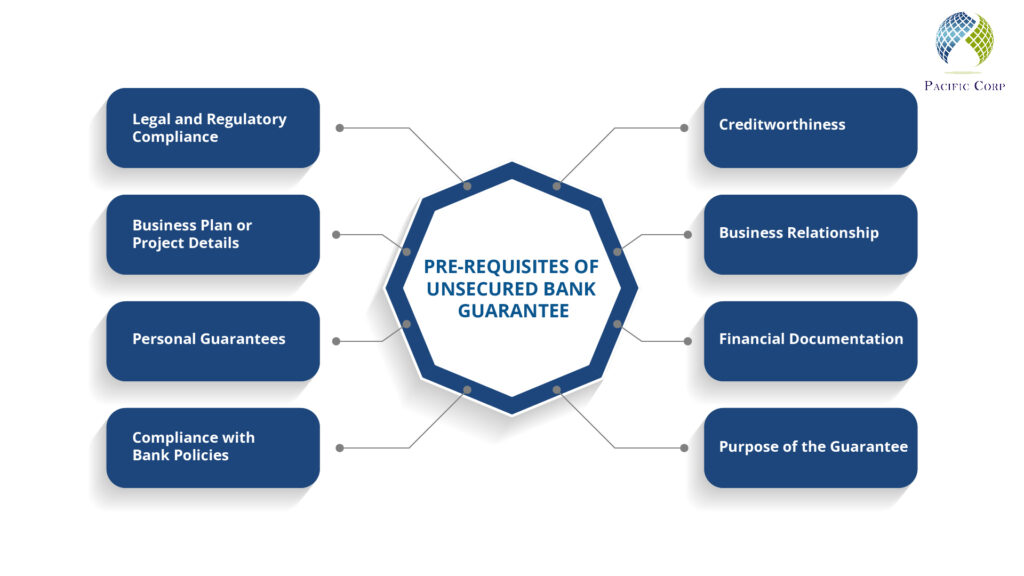

Here are some of the prerequisites for Unsecured Bank Guarantee

The power of Unsecured Bank Guarantee:

No collateral constraints:

Unlike traditional bank guarantees that often require collateral, the unsecured bank guarantee eliminates this constraint. This means businesses, especially smaller enterprises or those with limited assets, can leverage Unsecured BG services without tying up valuable collateral.

Enhanced financial flexibility:

Unsecured Bank Guarantees provide businesses with enhanced financial flexibility. This flexibility is crucial for seizing emerging opportunities, managing cash flow effectively, and engaging in a diverse range of transactions without being encumbered by collateral obligations.

Support for growing businesses:

For businesses in the growth phase, Unsecured Bank Guarantee services act as a catalyst. They offer the necessary financial support to explore new markets, enter into strategic partnerships, and undertake projects that contribute to overall expansion.

Streamlined trade transactions:

Unsecured Bank Guarantees streamline trade transactions by instilling confidence among parties involved. Whether it’s ensuring payment to suppliers or demonstrating financial commitment in contractual agreements, this financial tool contributes to the efficiency of global trade operations.

Accessible to Small and Medium Enterprises (SMEs):

SMEs often face challenges in accessing traditional financing options that demand substantial collateral. Unsecured Bank Guarantees level the playing field by providing these businesses with a viable and accessible financial instrument to participate in international trade and compete on a larger scale.

How Unsecured Bank Guarantees unlock financial growth:

Facilitating international trade:

Unsecured Bank Guarantees play a pivotal role in facilitating international trade. Businesses can engage in cross-border transactions with confidence, knowing that their financial commitments are backed by the issuing bank.

Encouraging business expansion:

The absence of collateral requirements encourages businesses to expand their operations. Unsecured Bank Guarantees allow companies to allocate resources more efficiently, directing funds toward growth initiatives rather than tying them up in collateral.

Seizing time-sensitive opportunities:

In dynamic business environments, time is of the essence. Unsecured Bank Guarantees enable businesses to act swiftly on time-sensitive opportunities, providing the financial assurance needed to enter into agreements without delays.

Building trust in transactions:

Trust is the foundation of successful business transactions. Unsecured Bank Guarantees build trust among parties by assuring them that financial commitments will be honored, fostering stronger and more reliable partnerships.

How to apply for Unsecured BG funding?

Securing financial growth for your business often requires tapping into various funding options, and Unsecured Bank Guarantees stand out as a powerful tool. Whether you’re a small business looking to expand or a larger enterprise aiming for financial flexibility, understanding how to apply for Unsecured Bank Guarantee Funding is crucial. Let’s navigate the steps to ensure a seamless application process:

1. Define your funding needs:

Before diving into the application process, clearly define your funding needs. Assess the specific requirements of your business, considering factors such as transaction volume, project scale, and the nature of financial commitments.

2. Choose a trusted unsecured BG service:

Selecting a reliable Unsecured BG service/provider is paramount. Look for a financial institution with a solid reputation, experience in international trade finance, and a commitment to transparent and flexible funding solutions.

3. Application submission:

Initiate the application process by submitting the necessary documentation to the chosen bank or financial institution. The required documents may include financial statements, business plans, details of the transaction, and any other information relevant to the funding request.

4. Transparent communication:

Maintain transparent communication with the chosen provider. Clearly articulate your business needs, the purpose of the Unsecured BG, and any specific terms or conditions you seek. Open and honest communication fosters a better understanding between the parties involved.

5. Provide business information:

Furnish comprehensive information about your business, including its financial health, operational history, and any specific industry-related details. This information helps the bank assess the viability of providing Unsecured Bank Guarantee Funding tailored to your business requirements.

6. Evaluate terms and conditions:

Carefully review the terms and conditions proposed by the bank. Pay attention to aspects such as fees, interest rates (if applicable), and the duration of the Unsecured Bank Guarantee. Ensure that the terms align with your business objectives and financial capabilities.

7. Compliance with regulations:

Confirm that your business and the proposed Unsecured BG comply with international trade regulations and legal standards. Adhering to these regulations is essential for a smooth application process and the subsequent utilization of the Unsecured Bank Guarantee.

8. Seek legal advice if necessary:

If the terms and conditions involve complex legal aspects, consider seeking legal advice. Legal professionals specializing in international trade can provide insights and ensure that you fully understand the implications of the Unsecured Bank Guarantee Funding arrangement.

9. Finalize Agreement:

Once both parties are satisfied with the terms, finalize the agreement. Ensure that all agreed-upon conditions are clearly documented, and both you and the bank have a comprehensive understanding of the Unsecured Bank Guarantee arrangement.

10. Leverage Unsecured Bank Guarantee:

With the Unsecured Bank Guarantee in place, leverage it strategically for your business objectives. Whether it’s entering into new partnerships, participating in international trade, or pursuing growth opportunities, the Unsecured Bank Guarantee becomes a valuable financial instrument.

Why Choose Pacific Corp for Unsecured Bank Guarantee services:

Pacific Corp stands as a trusted partner in unlocking financial growth through Unsecured Bank Guarantee service. With a commitment to transparency, flexibility, and personalized service, Pacific Corp empowers businesses to navigate the complexities of international trade and pursue financial expansion with confidence.

Conclusion

Unsecured Bank Guarantees emerge as a dynamic force, providing businesses with the financial flexibility needed to unlock growth opportunities. Whether you are a small enterprise looking to compete globally or an established business aiming for expansion, the power of Unsecured Bank Guarantees lies in their ability to eliminate collateral constraints and foster financial growth. Choose Pacific Corp as your partner in this financial journey, and unlock the full potential of your business.

Get In Touch

Subscribe to Our Newsletter