Trade Finance : A Comprehensive Guide for Beginners

Welcome to the world of trade finance, where businesses of all sizes unlock the power of global trade. In this comprehensive guide, we’ll delve deep into the intricacies of trade finance, exploring its different types, the trade finance providers who offer these services, the benefits they bring to businesses, and much more. Whether you’re new to international trade or looking to deepen your understanding of trade finance, this guide is your roadmap to success.

What is Trade Finance?

Trade finance is a set of financial tools and services designed to make international trade easier and safer for everyone involved.

Imagine you’re a business in one country selling goods to a buyer in another country. You want to make sure you get paid for your goods, and the buyer wants to make sure they receive the goods they ordered. That’s where trade finance comes in. It provides things like letters of credit, bank guarantees, and supply chain financing to make sure both parties are protected and the transaction goes smoothly.

In simple terms, trade finance ensures that goods get delivered and payments get made, no matter where in the world you’re doing business.

Trade finance is the backbone of international trade, encompassing a range of financial instruments and services designed to facilitate cross-border transactions. From letters of credit and bank guarantees to supply chain finance and export credit insurance, trade finance solutions come in many forms, each serving a specific purpose in the global marketplace.

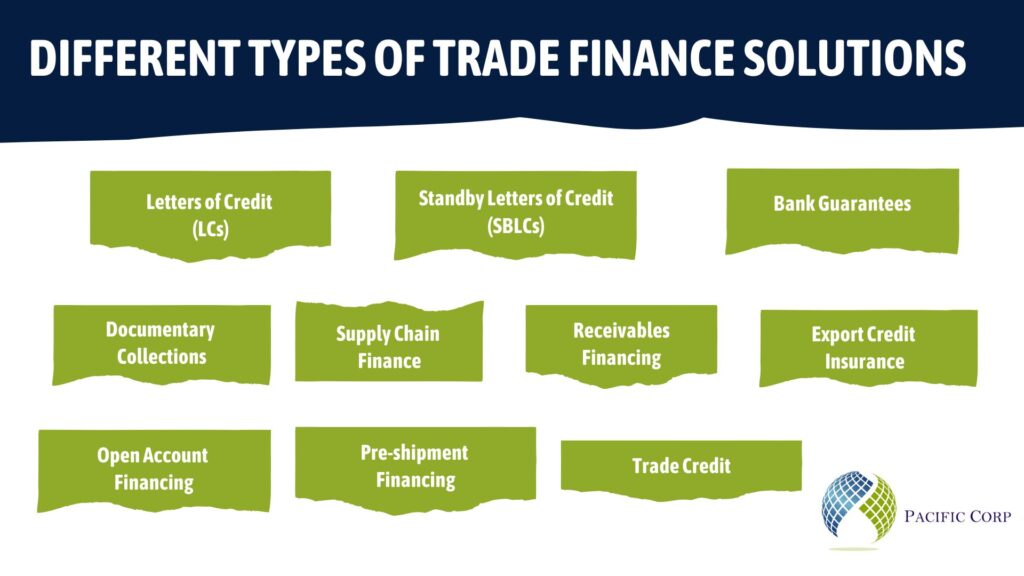

Different Types of Trade Finance Solutions

Let’s take a closer look at some of the most common types of trade finance solutions,

- Letters of Credit (LCs)

LCs provide payment security to both buyers and sellers by guaranteeing that payment will be made once certain conditions are met, such as the presentation of compliant shipping documents.

- Bank Guarantees

These instruments serve as a promise from a bank to a beneficiary (often a seller) that if the buyer fails to fulfill their obligations, the bank will cover the losses.

- Supply Chain Finance

This solution helps optimize cash flow by allowing suppliers to receive early payment on their invoices, while buyers can extend their payment terms.

- Export Credit Insurance

Insurance policies protect exporters against the risk of non-payment by buyers, ensuring they get paid even if the buyer defaults.

The Role of Trade Finance Providers

Trade finance providers play a crucial role in facilitating international trade. These providers can be banks, financial institutions, or specialized trade finance companies. They offer a range of services, including financing, risk mitigation, and transactional support.

Understanding the trade finance essentials ideal for your business requirements will help optimize the expertise of Trade Finance Providers to help you make better trade agreements. By leveraging their expertise and global networks, you can access the financial tools and resources you need to navigate the complexities of international trade successfully.

Benefits of Trade Finance companies/providers

Trade finance companies offer numerous benefits to businesses engaged in international trade, including

- Payment security

Trade finance solutions like LCs and bank guarantees provide assurance that sellers will receive payment for their goods and services.

- Improved cash flow

Solutions like supply chain finance enable businesses to optimize their cash flow by speeding up payments or extending payment terms.

- Risk mitigation

Trade finance companies help businesses mitigate risks associated with non-payment, currency fluctuations, and political instability.

- Access to financing

Trade finance providers offer financing options tailored to the needs of businesses engaged in international trade, helping them access the capital they need to grow and expand their operations.

How to Choose the Right Trade Finance Solution

Choosing the right trade finance solution for your business requires careful consideration of factors such as transaction volume, risk tolerance, and specific trade requirements. Businesses should also evaluate the reputation, expertise, and global reach of trade finance providers before making a decision.

Check out our Trade Finance Solution checklist to help you choose the right finance solution for your business By conducting thorough research and seeking guidance from experts, businesses can find the perfect trade finance solution to meet their needs.

Emerging Trends in Trade Finance

The world of trade finance is constantly evolving, driven by technological advancements, changing regulatory landscapes, and shifting market dynamics. Some of the emerging trends in trade finance include

- Digitization

Digital platforms and blockchain technology are transforming trade finance processes, making them more efficient, transparent, and secure.

- Sustainability

Businesses are increasingly incorporating environmental and social considerations into their trade finance strategies, driving demand for sustainable finance solutions.

- Supply chain resilience

The COVID-19 pandemic highlighted the importance of resilient supply chains, leading to greater emphasis on risk management and contingency planning in trade finance.

Whether you’re a small business looking to expand into new markets or a multinational corporation managing a global supply chain, trade finance offers the tools and resources you need to succeed. So dive in, explore your options, and unlock the full potential of global trade with trade finance.

Ready to take your international trade to the next level? Contact Pacific Corp today to explore our tailored trade finance solutions and unlock new opportunities for your business!

Get In Touch

Subscribe to Our Newsletter