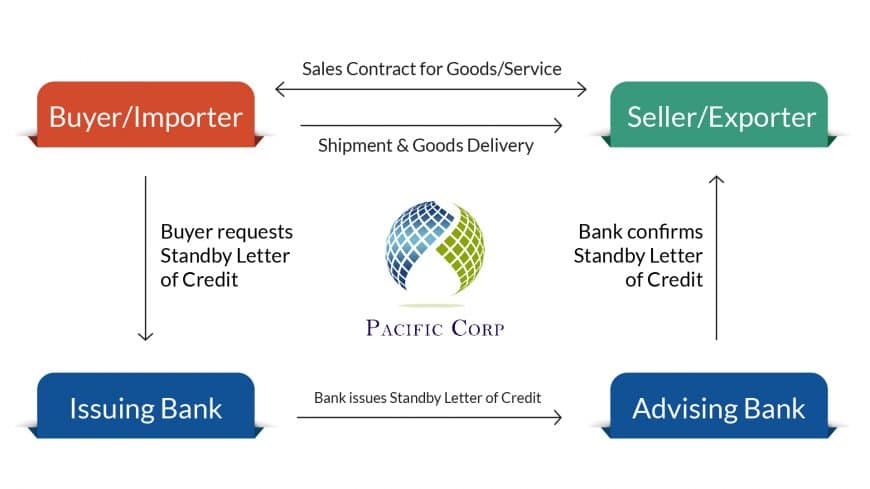

A standby letter of credit (SBLC) is a document from a bank or financial institution or direct standby letter of credit providers that guarantees payment for a client. It is often used as a guarantee of payment and can serve as a backup in case the client is unable to fulfill their financial obligations.

With years of experience in the industry, at Pacific Corp we are experts in providing direct & reliable SBLC services for businesses of all industries and all sizes.

Similar to a traditional letter of credit, an SBLC ensures that the beneficiary will receive the agreed-upon amount of money if certain conditions are met. This can provide reassurance to both parties involved in a transaction and mitigate the risk of non-payment. SBLC Direct Service Providers are commonly utilized in international trade, construction projects, and other business

Standby letter of Credit

Use a Standby Letter of Credit to avoid the following issues

Payment Delays:

A Standby Letter of Credit (SBLC), ensures timely payments, and helps avoid delays that can affect your financial stability.

Dispute Resolution Challenges:

SBLCs can simplify dispute resolution by providing a clear framework for payment, helping to avoid prolonged disagreements.

Unpredictable Cash Flow:

Uncertainty in Trade Agreements:

Having an SBLC in place adds a layer of security to your trade agreements, promoting trust between you and your trade partners.

Financing Difficulties:

SBLCs can enhance your credibility, making it easier to secure financing and access capital for your business growth.

Export/Import Regulatory Issues:

SBLCs can help you navigate the complexities of export/import regulations by providing assurance to authorities.

Market Expansion Challenges:

SBLCs can facilitate your expansion into new markets by mitigating financial risks associated with international trade.

One of the main advantages of utilizing a standby letter of credit is to avoid the risk of non-payment. By having a financial institution guarantee payment, both parties involved in a transaction can have peace of mind knowing that they will receive the agreed-upon amount of money. SBLC Direct Service Providers can be particularly beneficial in international trade, where there may be uncertainties or complexities that could potentially lead to non-payment. Furthermore, for construction projects or other business ventures, an SBLC can provide an additional layer of security, ensuring that financial obligations are met even if unforeseen circumstances arise.

Types of Standby letter of credit:

Financial SBLC:

This type of SBLC is often used to guarantee financial obligations, such as loans, payments, or financial transactions.

Performance SBLC:

This type of SBLC is often used to guarantee financial obligations, such as loans, payments, or financial transactions.

Note:

A Standby Letter of Credit (SBLC) is termed “standby” because it primarily serves as a backup or secondary payment guarantee, standing by to be activated only when certain conditions or obligations are not met. It is not meant to be the primary method of payment but acts as a safety net in case the primary payment method fails.

No Collaterals or assets?

You can still get an Unsecured Standby Letter of Credit to keep you going.

An Unsecured Standby Letter of Credit (Unsecured SBLC) is a financial instrument issued by a bank that provides a payment guarantee to a beneficiary (usually a seller or counterparty) without requiring the applicant (buyer or obligor) to pledge collateral. This means that the beneficiary will receive payment under the unsecured SBLC issued based on the fulfillment of specified conditions or obligations, and the buyer does not need to secure the SBLC with collateral assets.

Unsecured SBLC issuances offer financial flexibility and enable businesses to engage in international trade without tying up their assets as collateral.

With Pacific Corp as your unsecured Standby Letter of Credit provider, you can streamline your operations and focus on what you do best, knowing that your financial commitments are securely managed.

Why Choose Pacific Corp for Your Unsecured SBLC?

Expertise and Experience:

Our trade finance experts at Pacific Corp have years of experience. We understand the nuances of international trade and possess the knowledge to structure Unsecured SBLCs that align with your specific needs.

Customized Solutions:

We don’t believe in one-size-fits-all solutions. At Pacific Corp, we take a personalized approach, for your Unsecured SBLC issuance tailored precisely to your unique trade agreements, ensuring they meet your specific requirements.

Risk Mitigation:

Unsecured SBLCs are all about mitigating risk, and we take this commitment seriously. When you partner with Pacific Corp, you gain access to a powerful tool that reduces the risk of non-payment or default in your international transactions, protecting your financial interests.

Enhanced Credibility:

We understand that tying up your assets and capital can hinder your business growth. With an Unsecured SBLC from Pacific Corp, you can preserve your capital while confidently engaging in global trade.

Financial Flexibility:

We understand that tying up your assets and capital can hinder your business growth. With an Unsecured SBLC from Pacific Corp, you can preserve your capital while confidently engaging in global trade.

Transparent Process:

Our commitment to transparency means you’ll always have a clear understanding of the Unsecured SBLC process, allowing you to make informed decisions for your business.

Operational Efficiency:

Pacific Corp as your Unsecured Standby Letter of Credit provider streamlines your operations by ensuring payments are made promptly and efficiently, freeing up your resources to focus on core business activities.

Support and Guidance:

Beyond the Unsecured SBLC issuance, we’re here to support you every step of the way. Whether you’re a startup with ambitious goals or an established player looking for a trusted partner, Pacific Corp is here to help you navigate the complexities of international trade.

Our SBLC Process:

At Pacific Corp, we practice a streamlined and secure Standby Letter of Credit (SBLC) process, designed to facilitate international trade with efficiency and transparency.

Consultation and Assessment:

We initiate with a thorough consultation to understand your business objectives, trade agreements, and unique needs. Our experts assess your situation to recommend the most suitable SBLC solution.

Application and Documentation:

We guide you through the application and documentation phase, ensuring all paperwork aligns with the SBLC terms.

Underwriting and Approval:

Our experienced underwriters evaluate your creditworthiness, leading to prompt approval and SBLC issuance.

SBLC Issuance:

We efficiently issue the SBLC, adhering to agreed-upon terms and conditions.

Trade Agreement Integration:

We seamlessly integrate the SBLC into your trade agreement, building recognition and trust with your trade partners.

Shipment and Compliance:

As you fulfill contractual obligations and ship goods or services, we provide guidance to ensure strict SBLC compliance.

Document Submission:

We facilitate document submission to the beneficiary’s bank, ensuring alignment with SBLC stipulations.

Payment or Performance:

Closure and Reporting:

Ongoing Support:

At Pacific Corp, we recognize that international trade demands precision and reliability. Our SBLC process offers you the financial security and access you need to expand your trade overseas. Contact us today to explore how our SBLC services can elevate your international trade endeavors.

Frequently asked questions

Yes, SBLCs can be confirmed. A confirmed SBLC means that a second bank, typically in the beneficiary’s country, adds its confirmation to the SBLC. This confirmation serves as an additional payment guarantee and enhances the credibility of the SBLC.

Obtaining an SBLC can vary in difficulty depending on factors such as the applicant’s creditworthiness, the issuing bank’s requirements, and the complexity of the transaction. While it may not be overly complicated for established businesses with strong financials, it can be more challenging for startups or those with weaker financial profiles.

Standby Letters of Credit (SBLCs) serve various purposes in international trade and commerce. Common uses include:

- Providing financial assurance for contractual agreements.

- Ensuring timely payments and performance in commercial transactions.

- Facilitating trade deals by mitigating risks for both parties.

- Acting as collateral for financing arrangements.

- Serving as a payment guarantee in project-based transactions.

Utilizing SBLC direct service providers can offer several advantages, including:

- Access to tailored SBLC solutions that meet specific trade requirements.

- Expert guidance and support in navigating the complexities of SBLC issuance and usage.

- Faster processing and issuance of SBLCs, facilitating smoother trade transactions.

- Enhanced credibility and trust with trade partners due to the involvement of reputable service providers.

- Reduced risks of non-payment or default, thereby safeguarding financial interests.

- Potential access to additional financial services and resources through established service provider networks.

The primary difference between a letter of credit (LC) and an SBLC is their intended use. An LC is primarily used for international trade transactions to ensure that a seller is paid by a buyer upon presentation of compliant documents. In contrast, an SBLC is a secondary payment guarantee that serves as a backup if the applicant fails to fulfill specific contractual obligations. SBLCs are often used when additional financial security is required beyond a traditional LC.

Get In Touch

Subscribe to Our Newsletter