Innovations in Trade Finance: Embracing Digital Transformation

Do you ever think how much faster, simpler and more digital trade finance could be? Within this ever-changing world, institutions have an incredible chance to modernize their operations and cut costs while increasing client satisfaction by embarking on the road to digital transformation in today’s landscape.

The good news is with more effective risk management of trade finance, speedier digital transformation transactions, and overall efficiency is possible.

Institutions can mitigate the complexities and risks in cross-border transactions by automating and digitizing trade finance, thus speeding up and securing the deals.

Digitization of trade finance allows for real-time tracking of commodities, timely processing of documents, and faster approvals, removing any delays and costs that have, until now, been impediments to international trade.

- Digital transformation: 53% banks and 52% corporates want processes to be more digital concerning trade finance.

Trade Finance Digital Transformation Analysis

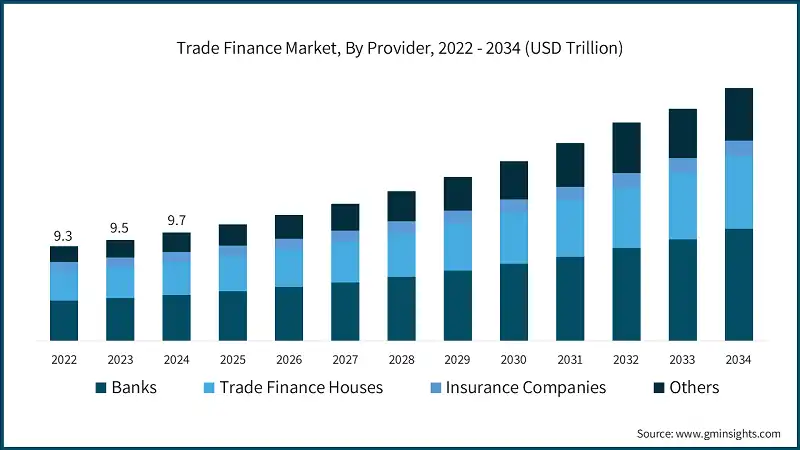

The digitalization of trade finance is seeing a fast-tracked transformation; from traditional paper processes to digital workflows in international trade, and the figures are as follows:

- The global trade finance market was estimated to be worth nearly $7.6 trillion in 2024 and account for over 45% of global traditional trade finance transactions by 2025; thus, it helped to reduce the financial gap by 15%.

Key Innovations in Trade Finance Digitization

1.Blockchain Integration into Trade Documentation: Before blockchain solutions, document processes typically took 5-10 days to compete for international trade transactions but they reduced that time down to 24-48 hours. Major trade finance platforms using blockchain report:

- 70 percent reduction in manual data entry needs

- 80 percent reduction in document review time

- 50 percent reduction in compliance costs

2. Artificial Intelligence and Machine Learning Applications: AI-powered systems are changing the ways of risk assessment and those for fraud detection:

- 35 percent increase in accuracy for risk assessment

- 60 percent reduction in false positive alerts for compliance

3.Interconnectivity through APIs: APIs integration has given a new lease of life to trade finance procedures today by enabling banks to communicate and share data therein.

With APIs facilitating inter-system and inter-party communication, totally integrated trade finance processes now work just about in real time effectively.

Major breakthroughs:

- Efficacy in cross-border payments increased by 55%

- Operational cost reduction of 65%

- Real-time monitoring systems are improved by 75%

4.Cloud-Based Trade Finance Platforms: Cloud platforms provide solutions to banks with small asset bases toward the implication of the clients and act more competitively against large organizations, with the assurance of high security standards and compliance with regulations.

Notable improvements within trade finance digital transformation :

- 40% reduction in operational infrastructure costs

- 90% increase in accessibility to such documents

- 30% increase in processing capacity

Trade Finance Industry Insights

In December 2024 the HSBC Bank and the International Finance Corporation (IFC) of the World Bank launched, under the Trade Finance Program, a $1 billion umbrella fund aimed at closing the finance gap in developing countries.

Trade-related asset portfolios are held by banks in more than 20 countries for Asia, Africa, Latin America, and the Middle East under a platform of risk-sharing with both institutions having equal efforts for the system.

Your Trusted Partner in Trade Finance Solutions: Pacific Corp.

Making sure that your business gets everything it could need is why we have partnered with a large number of trusted associates.

We are here to support you-regardless of the size of your company-with letters of credit, standby letters of credit (SBLC), bank guarantees, or performance guarantees. We have the know-how and resources for the truly safe and secure way of doing international transactions.

We pride ourselves on making sure what we deliver for you is the best solution for your distinct trade and financial requirements.

Our dedicated teams ensure that they are smooth enough for you to worry-free proceed within the ever more digital and globalized trade environment.

Besides, we do not simply move transactions but assist our partner in building the future of the business. So what are you waiting for? Partner with us for financial success in an international trade context.

Get In Touch

Subscribe to Our Newsletter