Everything You Need to Know About Proof of Funds in International Trade

What is Proof of Funds (POF)?

Proof of funds is a document or bank statement that showcases the financial capability of a person/company to undertake the transaction. With this, the other party or the parties will easily be able to be assured of the financial capability required for the transaction to be procurable and legitimate. This makes the trading process smoother.Why is POF important in International Trade?

Cross border trade can be financially risky. More particularly, If you are dealing with new partners or large transactions. In all this, you need to make sure that payments go through without hiccups. POF helps to reduce that uncertainty by showing upfront that finances are available. This simple step can significantly lower risks and make your transactions more secure.1.Builds Trust

Proof of Funds informs sellers that buyers have the financial source to complete the transaction. This builds trust and reliability between the trading partners.

2. Reduces Risk

With a POF in place, Sellers can understand the capability of the buyer before making the deal. Sellers can avoid potential losses by confirming that buyers can pay before shipping the goods. This ultimately reduces the risk of defaults and disputes.

3. Facilitates Financing

Some financial institutions require POF to approve trade financing. POF helps assure them that you as a buyer are financially capable to fulfill the contract obligations.

4. Compliance & Regulations

In many countries, the regulations require POF for certain transactions to prevent money laundering and fraud.

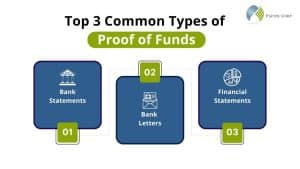

Common Types of Proof of Funds

Depending on the nature of your deal, you need to choose the right type of POF. To some, Bank statement is a good enough assurance but some deals would require a formal Bank Letter. Here, are the three most common types of POF in Global trade. 1. Bank Statements

1. Bank Statements- A quick and easy option

- Show available finances in the account

- Often used for smaller or less formal transactions

- A formal option

- More credible & acceptable world-wide

- Specifically for large deals & unfamiliar partners

- Ideal for Large Transactions

- Includes more information

- Offers a deeper look into the company’s overall Finances

When is Proof of Funds required?

When running an international business, the stakes can be very high. It is better to always opt for more formal ways to minimize risks, build trust between your partners. A POF is the saviour during the following situations.1.High Value Transactions

Larger deals equals larger risks, so using a Proof of Funds document is a must.

2. New Business Relationships

When you are building credibility with a new partner overseas, POF can help build the trust gap.

3. International Transactions

Cross border deals are tricky if not dealt the right way. A POF adds a layer of security against all of those risks.

4. Trade Financing

If your Trade requires loans and letters of credit, having a Proof of Funds document can easily streamline and smoothen the process.

How to obtain Proof of Funds letter?

In global trade, delays or misunderstandings can cost you both time and money. You need to prepare the right documents in advance. To avoid unnecessary complications, they meet the specific requirements.1.Obtain Documentation

Collect all the official documents from your bank that reflect your available balance.

2.Maintain Clarity

Make sure the documents are easy to understand, with key details like your name and balance clearly shown.

3.Check Requirements

Different deals may have different POF requirements. So, don’t forget to verify with your trading partner what’s needed.

4.Keep it Updated

Providing outdated information can stall negotiations. So always use the current documentation.

Proof of Funds are a simple yet powerful tool that helps businesses trade seamlessly grow. Pacific Corp offers expert Proof of Funds (POF) services to help you build trust and reduce risk. So if you are looking to secure your business interests, we ensure you prompt POF services from start to finish. Let us help you protect your transactions and grow your international business! Contact us today!Get In Touch

Subscribe to Our Newsletter