Role of Documentary Letter of Credit in International Trade

One of the most commonly used instruments for cross-border trade is the documentary letter of credit (DLC).

It is a guarantee given by the bank to ensure that the buyer pays the seller, provided the seller submits all the required documents showing that the goods were shipped by such date. This guarantees protection to both parties in international trade.

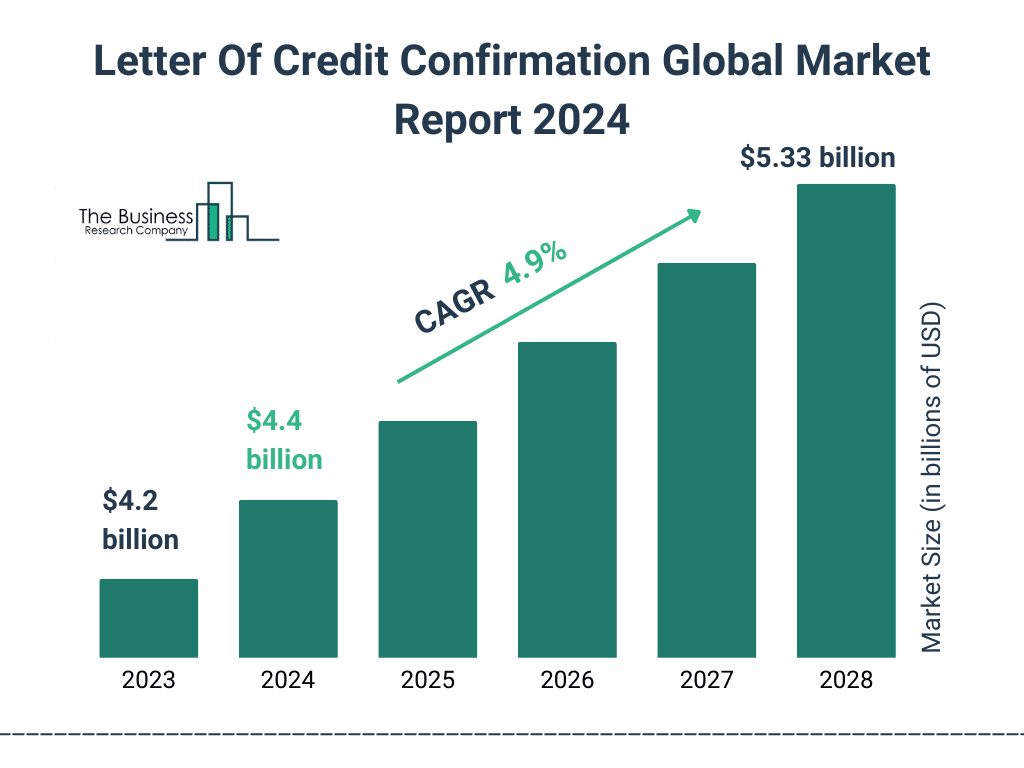

In recent years, the letter of credit confirmation market size has shown a steady trend of growth. At a compounded rate of 4.9%, projections indicate a rise from $4.2 billion in 2023 to about $4.4 billion in 2024.

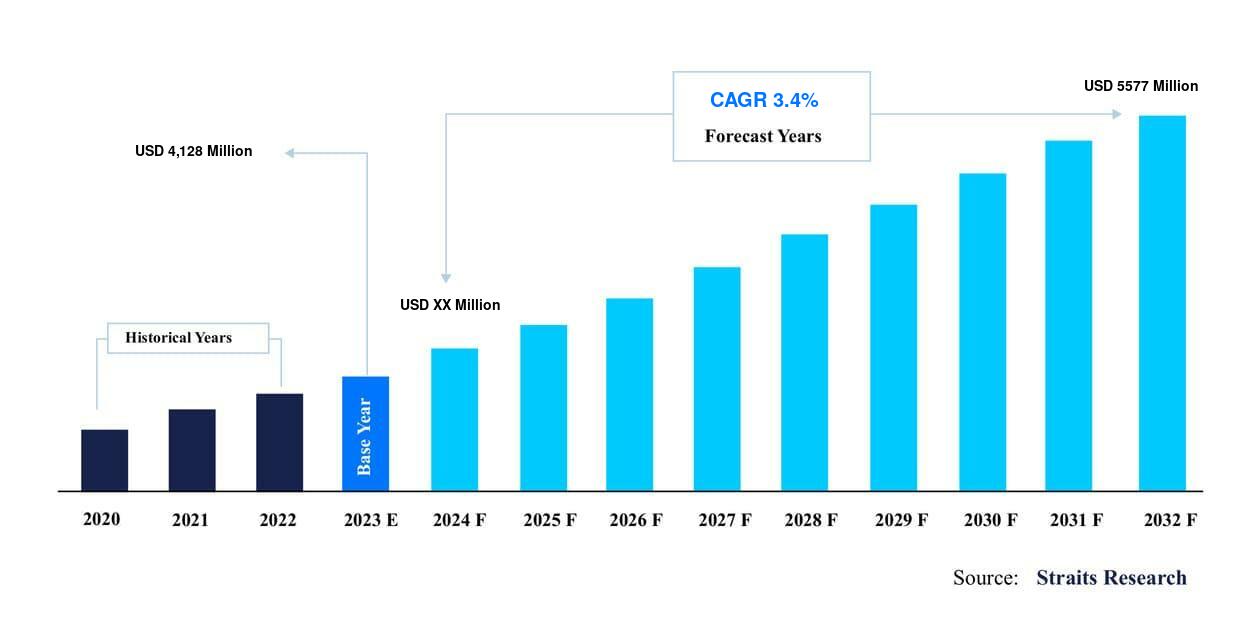

The year 2021 was worth USD 4,128 million and is thereby expected to flourish further to grow up to USD 5,577 million by 2030, at a steady compound annual growth rate (CAGR) of 3.4% for the years 2022 to 2030.

This reflects the increasing demand for more secure, trustworthy, and timely methods for companies and financial institutions to tackle the complexity involved in international commerce through trade finance solutions.

Role of Documentary Letter of Credit in International Trade

1.Advanced Blockchain Technology

Integrating blockchain technology with the process of documentary letters of credit (DLC) is aimed at replacing the paper trails to digitise and secure the entire process of international trade transactions.

Reports say that the Asia-Pacific region will have the largest share of the market, with a compound annual growth rate (CAGR) of 5.71 percent. This is mostly because the trade finance services industry is continuing to grow, and developing economies are becoming more dependent on Letters of Credit (LCs) and the laws that govern them are changing.

Also, smart contracts can be built into the blockchain and can automatically do important things like making sure rules are followed and sending money when certain conditions are met. This gets rid of the need for middlemen and human intervention in most cases.

2.Driving Safe and Quick Cross-Border Transactions

The sight L/C segment would continue to lead the market share growth, with a CAGR of 2.87%, because it is so safe and quick for international trade payments.

Several financial institutions use sight L/Cs, which guarantee document verification and 72-hour payment processing.

Ultimately, the dealer trusts the process, resulting in better liquidity. Besides that, usage of L/Cs has the option of late payment, so buyers will have a longer time for paying and less finance cost.

Trade finance solutions would be seamless for larger companies with DLCs using these principal, very secure, cross-border transaction methods.

3.Enhancing Export Growth & Reducing Credit Risk

In the year 2030, India’s merchandise exports are projected to touch a record $1 trillion, having crossed the $418 billion threshold this year.

To achieve this target and to further strengthen export-led growth across Indian enterprises, it would be necessary to make full use of their entire potential in global trade.

The next step is to enhance the trust between buyers and sellers along with the effective management of all risks associated with such transactions.

According to the experts, the documentary letter of credit securities will reach beyond US$ 5 billion during the year 2030 because of increasing international trade. They will play a pivotal role in this regard, providing a safe and dependable payment method that minimises the risk for both exporters and importers.

4.International Facilitation Trade for SMEs

Documentary Letter of Credit supports international trade for small and medium enterprises (SMEs) through secured payment modes that will not hinder large upfront payments or a delay in payment.

5.Boosting Liquidity in Trade

The letters of credit add liquidity so that the seller can get paid as soon as he presents the required documents. This reduces the complication due to delayed payment and ensures better management of the cash flow for smoother transactions.

6.Improved Verification of Documents

The Documentary Letter of Credit guarantees that payments will be made on submission of specified documents, for example, bills of lading, commercial invoices, and source certificates, to the bank. As a consequence, it will help eliminate disputes between the buyer and seller over shipping and delivery.

How to Apply for a Documentary Letter of Credit?

To apply for a documentary letter of credit, the buyer approaches their bank and therefore indicates the trade terms. The bank now issues the LC and sends it to the seller’s bank. After the seller presents some required documents, like shipping and commercial invoices, the bank can verify them and now process the payment; thus, both parties are safeguarded from further risks in cross-border transactions.

Secure your International Transactions with Pacific Corp

We provide well-established documentary letter of credit (DLC) services for businesses of different sizes across different industries in the UK.

We have experience of more than 20 years in trade finance and thus, have the means to guarantee safety in transactions by providing fast, effective, and trustworthy solutions.

For more information on how our DLC services can secure your contracts and payment obligations, ultimately ensuring peace of mind for buyers and sellers, contact us today.