Standby Letter of Credit: Everything you need to know

International trade can be a challenging path to navigate. Have you ever been in a situation where you needed a safety net for your trade transactions? If you’re a business owner, you might have wondered about ensuring secure payments and building trust with partners worldwide.

Standby Letter of Credit (SBLCs) are like that safety net. They help businesses ensure they get paid when they fulfill their part of the deal. But understanding how SBLCs work and how to use them effectively can be puzzling.

At Pacific Corp, we understand the challenges of international trade. Whether you’re a seasoned trader or a budding entrepreneur, the need for a safety net in trade transactions is vital.

If you’ve ever pondered over these questions, you’re not alone. In this guide, we’ll simplify the world of SBLCs. We’ll explore what SBLCs are, how they work, and why they matter for businesses. Whether you’re new to international trade or looking to refine your understanding of SBLCs, let’s unravel the mystery together and equip you with the knowledge to trade confidently on a global scale.

What is a Standby Letter of Credit (SBLC)?

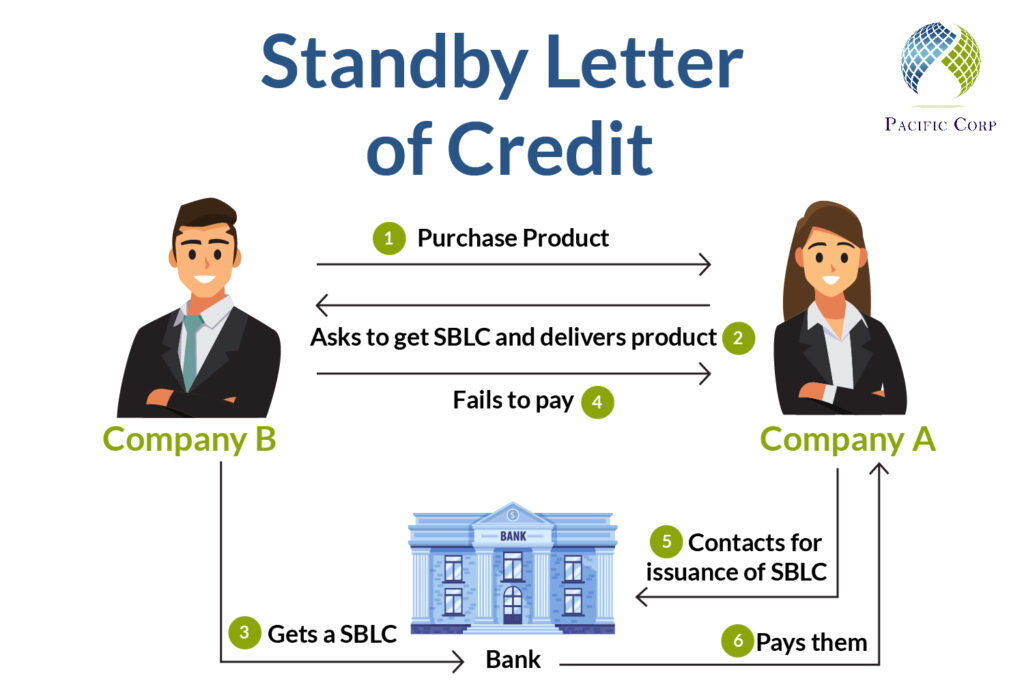

At its core, an SBLC is a financial guarantee issued by a bank on behalf of a buyer (applicant) to ensure that payment will be made to a seller (beneficiary) in the event the buyer fails to fulfill their contractual or financial obligations. Unlike commercial letters of credit that facilitate trade by ensuring payment upon the presentation of compliant documents, Standby Letters of Credit are a form of insurance against non-payment or default.

The Role of an SBLC

The primary role of a Standby Letter of Credit is to provide financial security and assurance to both parties involved in a transaction. Let’s explore how it achieves this:

Financial Security and Assurance

For Sellers (Beneficiaries):

- SBLCs provide sellers with a guarantee that they will receive payment, even if the buyer defaults on their payment obligations.

- This assurance encourages sellers to engage in trade with new or unfamiliar buyers, in markets where the risk of non-payment is a concern, or in high-value, complex, or long-term transactions.

For Buyers (Applicants):

- SBLCs assure buyers that they will only make payment to the seller upon the fulfillment of specific terms and conditions.

- This allows buyers to exercise greater control over the release of payment, ensuring that they receive the expected goods or services in accordance with the agreed terms.

Risk Mitigation

SBLCs mitigate the risks associated with non-payment or default, providing a level of certainty that enables businesses to explore new markets, expand their global presence, and engage in high-value or complex trade transactions with confidence.

Trade Facilitation

By instilling confidence in both parties, Standby Letters of Credit facilitate the smooth flow of goods and services across borders. They create a secure framework for timely and secure payments, contributing to the overall efficiency of global trade operations.

Support for Small and Medium Enterprises (SMEs)

By instilling confidence in both parties, Standby Letters of Credit facilitate the smooth flow of goods and services across borders. They create a secure framework for timely and secure payments, contributing to the overall efficiency of global trade operations.

Flexible Financing Options

SBLCs can also be leveraged as collateral for financing arrangements, allowing businesses to access capital and funding for their trade operations. This flexibility in financing options provides businesses with the necessary liquidity to seize emerging opportunities and expand their operations.

Key Considerations When Applying for an SBLC

Applying for a Standby Letter of Credit requires careful consideration of several key factors, including:

- Understanding of terms:

Thoroughly comprehend the terms and conditions of the SBLC, including expiry dates, claim procedures, and compliance requirements, to avoid any potential disputes or delays in payments. - Financial assessment:

Conduct a comprehensive financial assessment to determine the appropriate amount and type of SBLC required for your specific trade transaction. - Legal expertise:

Seek legal expertise to ensure that the SBLC aligns with all legal and regulatory frameworks governing international trade and commerce. - Risk evaluation:

Evaluate the potential risks associated with the transaction and ensure that the SBLC adequately addresses these risks to provide comprehensive financial security.

Tips for Maximizing the Benefits of SBLCs

To maximize the benefits of SBLCs in your trade transactions, consider the following tips:

- Clear communication:

Establish transparent communication channels with all parties involved to ensure a smooth and efficient SBLC issuance process, fostering trust and transparency. - Regular updates:

Stay updated with the progress of your trade transaction and monitor any changes in the terms and conditions of the SBLC to avoid any potential discrepancies or delays. - Document verification:

Verify all presented documents to ensure their compliance with the SBLC requirements and avoid any discrepancies that may hinder the payment process. - Compliance adherence:

Adhere to all international trade regulations and compliance standards to ensure seamless adherence and prevent potential complications and delays in the SBLC process.

Challenges and Limitations of SBLCs

While SBLCs offer significant advantages in international trade, it is essential to be aware of the potential challenges and limitations, including:

- Cost Implications:

There may be costs associated with the issuance and maintenance of an SBLC, which can impact the overall expenses of the trade transaction. - Regulatory Changes:

Changes in international trade regulations and policies can impact the terms and conditions of the SBLC, necessitating careful monitoring and compliance updates.

How to Choose a Reliable SBLC Provider

When selecting an SBLC provider, consider the following factors to ensure reliability and efficiency:

- Reputation and experience:

Opt for an SBLC provider with a strong reputation and extensive experience in handling international trade transactions. - Financial stability:

Choose a provider with a strong financial background and a sound track record in managing trade finances and transactions. - Customer support and service:

Look for a provider that offers excellent customer support and service, ensuring that your queries and concerns are addressed promptly and effectively. - Global network and reach:

Select a provider with a global network and reach, enabling seamless trade transactions across various geographical locations and markets.

In conclusion, Standby Letters of Credit (SBLCs) play a crucial role in fostering secure and efficient trade transactions, providing financial security, risk mitigation, and confidence for businesses engaging in global commerce. By understanding the key considerations, maximizing the benefits, and being aware of the challenges and limitations, businesses can effectively leverage the power of SBLCs to facilitate successful and profitable international trade operations. Choosing a reliable SBLC provider is essential in ensuring the smooth and secure execution of trade transactions, enabling businesses to navigate the complexities of international trade with confidence and ease.

At Pacific Corp, we strive to be your trusted partner in international trade, offering tailored SBLC solutions and comprehensive support to ensure the smooth execution of your trade transactions.

So if you’re ready to elevate your international trade experience with PAFCO? Get in touch with us today to explore how our SBLC solutions can empower your business for global success.

Get In Touch

Subscribe to Our Newsletter