The Complete Guide to Documentary Letter of Credit (DLC)

Welcome to the world of trade finance, where transactions span the globe, and assurance is key. If you’re venturing into international trade or looking to understand the intricacies of transactions, you’ve landed on the right page. Today, we’ll discuss Documentary Letter of Credit (DLC), a powerful instrument that forms the backbone of secure cross-border trade.

What is the difference between Letter of Credit & Documentary letter of Credit?

The terms “Letter of Credit” (LC) and “Documentary Letter of Credit” (DLC) are often used interchangeably, but there is a subtle distinction between them.

A Letter of Credit (LC) is a broad term encompassing various types of financial instruments issued by banks to guarantee payment on behalf of a buyer to a seller. Normal LCs provide assurance to the seller that they will receive payment, typically upon presentation of compliant documents confirming the fulfillment of contractual obligations.

On the other hand, a Documentary Letter of Credit (DLC) is a specific type of LC that explicitly involves the presentation of documents related to the transaction. The term “documentary” emphasizes the requirement for specific documents, such as invoices, bills of lading, and certificates of origin, to be presented by the seller to the bank for payment. The issuing bank releases funds to the seller only when these documents comply with the terms and conditions specified in the agreement.

In essence, while all DLCs are a form of LC, not all LCs are necessarily documentary in nature. The key distinction lies in the emphasis on documentary requirements, makes it a subset of the broader category of Letters of Credit.

Understanding Documentary Letters of Credit (DLC)

At its core, a Documentary Letter of Credit is a financial tool that ensures a smooth transaction between a buyer and a seller, especially when they’re in different parts of the world. Here’s how it works:

1. Initiation by the Buyer (Applicant):

The buyer initiates the DLC, essentially asking their bank (issuing bank) to guarantee payment to the seller.

2. Agreement on Terms:

Both parties, along with their banks, agree on the terms and conditions of the transaction. This includes details about the shipment, quality of goods, and other relevant aspects.

3. Issuance by the Bank:

The issuing bank issues the DLC to the seller, promising to make payment upon the presentation of specified documents. These documents typically include invoices, bills of lading, inspection certificates, and more.

4. Presentation of Documents:

The seller ships the goods and gathers the agreed-upon documents. These documents are then presented to the issuing bank.

5. Examination by the Bank:

The bank examines the documents to ensure they comply with the agreed terms. If everything aligns, the bank releases payment to the seller.

Key Players in a DLC Transaction

1. Applicant (Buyer): Initiates the DLC.

2. Beneficiary (Seller): Receives the DLC and fulfills the transaction.

3. Issuing Bank: Issues the DLC on behalf of the buyer.

4. Advising Bank: Communicates the DLC to the seller.

Why Use Documentary Letters of Credit?

1. Security for Both Parties:

Buyers are assured that they’ll receive the goods they paid for, and sellers have the guarantee of payment upon fulfilling their obligations.

2. Cross-Border Confidence:

DLCs provide a level playing field for international trade, where parties might not be familiar with each other’s business practices.

3. Risk Mitigation:

By tying payment to the presentation of compliant documents, the risk of non-payment or other disputes is significantly reduced.

Types of Documentary Letters of Credit

| Type of DLC | Description |

|---|---|

| Commercial Letter of Credit | Used for the purchase of goods and services, providing payment assurance to the seller. |

| Standby Letter of Credit | Acts as a backup payment method if the buyer fails to fulfill contractual obligations. |

| Irrevocable Letter of Credit | Cannot be modified or canceled without the consent of all parties involved. |

| Revocable Letter of Credit | Can be modified or canceled by the issuing bank without prior notice. |

| Revolving Letter of Credit | Automatically renewed for a specified period, accommodating multiple transactions. |

| Confirmed Letter of Credit | Involves a second bank, usually in the seller’s country, confirming the credit’s validity. |

| Red Clause Letter of Credit | Allows an advance payment to the seller before shipment. |

| Sight Letter of Credit | Payment is made upon presentation of compliant documents. |

At Pacific Corp, we understand the critical role that Documentary Letters of Credit (DLC) play in facilitating international trade. Our comprehensive services extend to providing you with a clear road map that meets the diverse needs of your business engaged in global transactions.

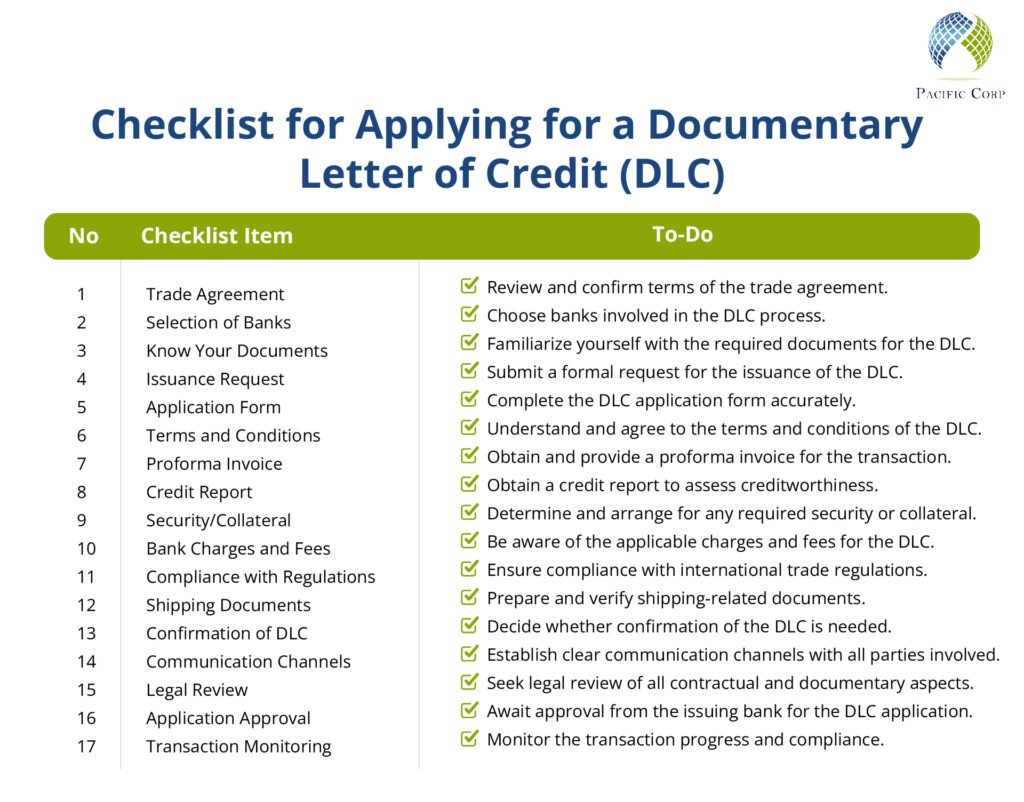

To make that process a little easier, here’s a checklist that’ll help you for apply for a Documentary Letter of Credit (DLC)

Tips for a Smooth DLC Transaction

1. Clear Communication:

Ensure all parties are on the same page regarding terms and conditions.

2. Understand Documents:

Know which documents are required and ensure they’re accurate and compliant.

3. Choose Reputable Banks:

Work with trusted banks to avoid complications.

Challenges and Solutions

1. Documentary Compliance:

Challenges can arise if the presented documents don’t align with the agreed terms. Detailed understanding and communication help overcome this.

2. Timeliness:

Delays can occur in the shipment or presentation of documents. A well-structured timeline can address these issues.

Do You Need a Documentary Letter of Credit Issuer?

One key player in this process is the DLC issuer, a financial institution that plays a pivotal role in ensuring secure and successful transactions. DLC providers, often banks or companies like us, act as intermediaries, providing a guarantee to the seller that they will receive payment once the specified conditions are met. Their role is not just about issuing documents; it’s about instilling confidence in both parties, creating a trustworthy environment for global transactions.

Documentary Letter of Credit issuers play a crucial role in mitigating risks associated with non-payment or default. By acting as a neutral party, they assure sellers that they will receive payment even if the buyer encounters financial challenges. They also ensure that the issued credits comply with legal standards. This compliance expertise adds a layer of security to transactions, reducing the likelihood of disputes.

So the next time you are looking for the support of an expert in your trade finance, reach out to a DLC provider, and they’ll provide you with all the information & support you need to make the right decision.

Understanding Unsecured Documentary Letter of Credit :

An Unsecured Documentary Letter of Credit (DLC) refers to a financial instrument used in international trade where the issuing bank provides a payment guarantee to the seller (beneficiary) without requiring any specific collateral or security from the buyer (applicant). In essence, it’s a form of credit that facilitates trade transactions without the need for the buyer to pledge assets as collateral.

Here’s a breakdown of the key components:

1. Payment Guarantee:

The Unsecured documentary letter of credit serves as a guarantee from the issuing bank to the seller that, upon meeting the terms and conditions outlined in the letter of credit, they will receive payment for the goods or services provided.

2. No Collateral Requirement:

Unlike secured letters of credit, which may involve the buyer providing collateral (assets or funds) to secure the transaction, an Unsecured documentary letter of credit does not necessitate any specific collateral.

3. Risk Distribution:

This type of DLC is advantageous for buyers who may not have readily available assets for collateral. It distributes the risk between the parties involved, offering a level of flexibility in trade transactions.

4. Standard Documentary Letter of Credit Procedures:

The general procedures of a Documentary Letter of Credit apply, where the issuing bank issues the credit based on the buyer’s request, and the seller fulfills the conditions, presenting the required documents to claim payment.

5. Creditworthiness Assessment:

While no collateral is required, the issuing bank may assess the creditworthiness of the buyer before approving an Unsecured DLC to ensure their ability to fulfill the payment obligations.

6. Trade Facilitation:

It plays a crucial role in facilitating international trade by providing a secure and trusted mechanism for payment, enabling businesses to engage in transactions with partners around the world.

It’s important to note that the decision to use an Unsecured DLC depends on the mutual agreement between the buyer and the issuing bank. Buyers benefit from not having to tie up significant assets as collateral, while sellers gain confidence in receiving payment upon fulfilling the terms of the letter of credit. This financial instrument adds a layer of assurance to trade transactions, fostering trust between parties involved.

Conclusion:

Documentary Letters of Credit might seem like a complex dance of documents and banks, but they are a tried-and-true method for secure international trade. As you navigate this world, remember the essence – it’s about trust, assurance, and ensuring that, in the vast landscape of global commerce, your transactions are secure and reliable.

Pacific Corp stands as your trusted partner, offering tailored solutions to navigate the complexities of international trade through our diverse range of Documentary Letters of Credit. Experience the assurance, efficiency, and growth that come with our expertly crafted trade finance services. Connect with us today and embark on a journey of successful global trade with confidence. Happy trading!

Get In Touch

Subscribe to Our Newsletter