Understanding Performance Bank Guarantees: Different Types and How They Work

What is a Performance Guarantee?

If the applicant does not comply with the performance of the contract for any reason, the bank compensates the beneficiary from the amount stated for any loss incurred.

Generally, performance guarantees are used in the construction industry, service contracts, or large-value projects where the completion of work is significant.

Types of Performance Guarantee

1.Payment Guarantee: The Payment Guarantee ensures the applicant’s payment for all goods or services supplied.

If an applicant defaults, the bank will stand in for beneficiary payment. Typically used in supply agreements, as the timely receipt of money for goods is vital in keeping a business running.

2.Letter of Credit (LC) Guarantee for Performance: In some instances, a Letter of Credit will act as a performance guarantee. This is typically used in International trade.

In such a case, it ensures a seller that after the shipment or receipt of goods, the buyer would provide an agreed payment.

In the event that the buyer does not provide payment as agreed upon, the bank ensures payment to the seller, reducing the risk of non-payment due to cross-border transactions.

3.Tender Guarantee/Bid Bonds: A bank guarantee offered by a bidder during a bidding process is called a tender guarantee, Bid Bond, or Tender Bond.

It ensures that the bidder will honour their offer and, if chosen, will sign a formal contract with the project owner or the organisation soliciting bids using the conditions specified in the bid.

As per reports, this segment is expected to retain the highest share in the global market for performance guarantees during the forecast period.

Tender guarantees are very important in public procurement and large-scale infrastructure projects when large money sums are at stake.

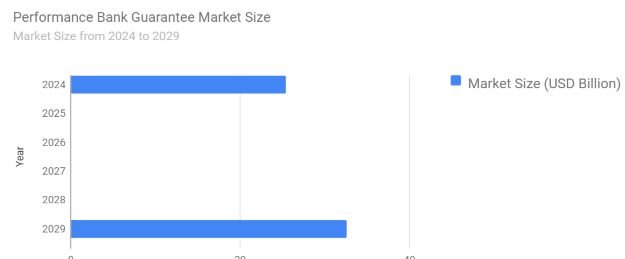

As per Mordor Intelligence report, the Performance Guarantee Market is projected to increase at a compound annual growth rate (CAGR) of 5.10% from 2024 to 2029, from an estimated USD 25.45 billion in 2024 to USD 32.64 billion by 2029.

How a Performance Guarantee Works: Simple Steps

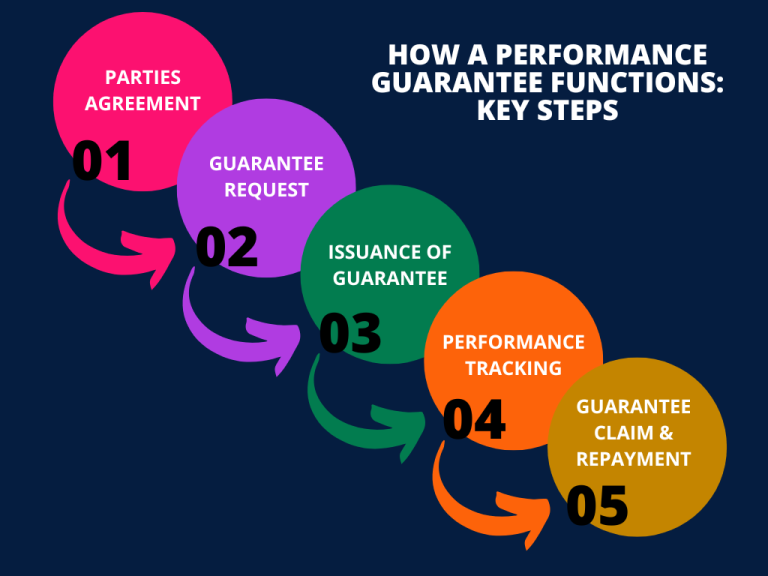

- The Contract for the Benefit of the Parties: A performance guarantee is required for a contract between the applicant and another party that will usually be referred to as the beneficiary, under which the applicant has committed himself to certain terms of the contract (for instance, either to complete a project or to deliver goods or services).

- Request for Guarantee: Therefore, the applicant may request the bank to issue a performance guarantee. By checking the financial status of the applicant, the bank may also ask for collateral or a fee for the issuance.

- Issuance of Guarantee: After being approved, the bank guarantees the beneficiary by stating that in case the applicant does not perform his obligations, the applicant will be indemnified up to the amount ensured.

- Performance Monitoring: During the term of the contract, the applicant must continue to comply with the terms of the contract (e.g., project milestones, and deadlines). The beneficiary may monitor this process for compliance safety.

- Claiming Honour Guarantee: In case the applicant contracts the default of completing the construction, then the beneficiary can claim the bank. The bank compensates the beneficiary for whatever loss he might incur.

- Repayment to the Bank: In that case, whenever the bank pays the amount, the applicant shall be liable to pay the bank and all fees and interests related to it.

Factors Influencing Performance Guarantee Market

- Digitalisation of Portals: Digitalisation transformed the performance guarantee industry by making the process quicker, clearer, and more cost-effective. This has made it easier for businesses, especially small and medium-sized enterprises (SMEs), to participate in international exchange and thus fuel the market.

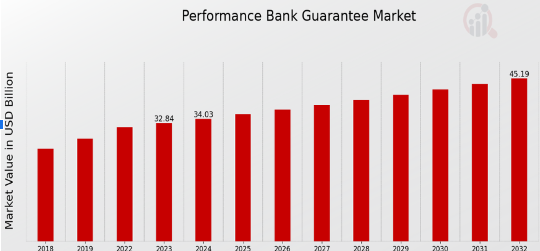

As per the Market Research Future report, it is anticipated that the performance bank guarantee will increase from 32.84 billion USD in 2023 to 45.2 billion USD in 2032.

- Effect of Trade Wars: Tensions in the world about certain rules of trade and trade disputes lead to uncertainties in international trade which resulted in greater caution by banks in issuing guarantees.

- High Volumes of Global Trade: With expanded globalisation, businesses are moving towards establishing international trade relations and accessing new markets. Therefore, performance guarantees are increasing to develop confidence and mitigate risks among trading partners.

Expert Bank Guarantee Solutions for Your Business

Make your commercial dealings free from losses. Pacific Corp offers an excellent bank guarantee service that can be tailored to your specific requirements.

With vast experience in the field as one of the leading trade finance providers in the UK, we will help you receive the bank guarantee that will protect your business.

Our highly competent trade finance experts will be able to provide you with the best advice and full support.

Final Thoughts

Bank guarantees ensure that both parties fulfil their obligations, whether it is securing a loan, signing an agreement, or expanding into new markets.

It is indeed the most efficient, accessible, and transparent mode of carrying out the processes with the use of the digital platforms emerging today.

Therefore, knowing how performance guarantees work and seeking the services of experts will enable any businessman like you to easily manoeuvre very complex financial arrangements without doubt and ensure your expansion.