choosing the best bank guarantee providers your ultimate guide

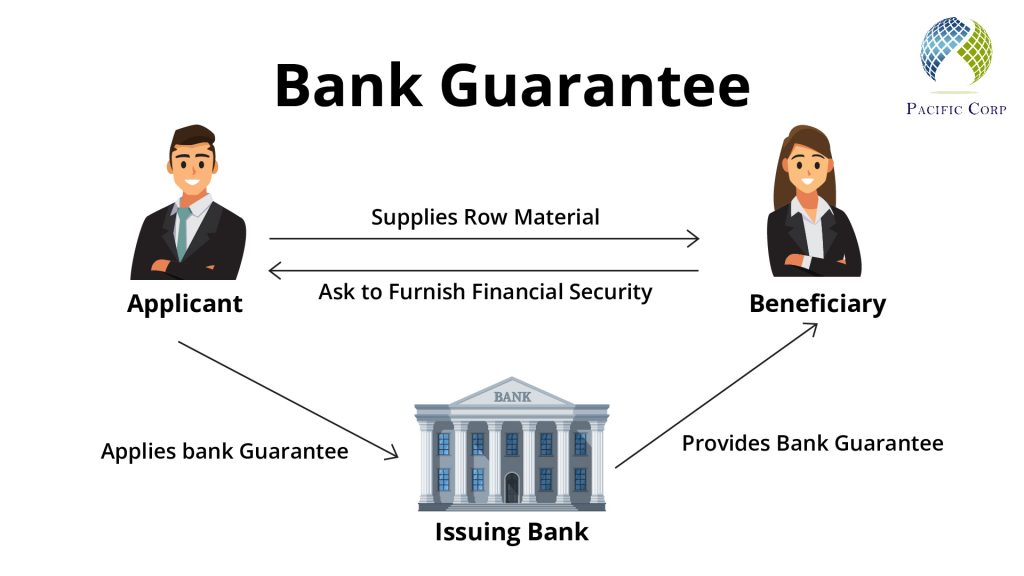

In the intricate world of international trade and commerce, where financial security is paramount, finding the right bank guarantee providers is a critical decision. A Bank Guarantee serves as a commitment from a financial institution to cover a specified amount in the event that a party fails to meet its contractual obligations.

As businesses venture into global transactions, selecting the best bank guarantee provider becomes essential for ensuring smooth operations and mitigating risks. In this ultimate guide, we’ll explore key considerations, types of bank guarantees, and tips for choosing the best providers to safeguard your business interests.

Understanding Bank Guarantees:

Before delving into the guide, let’s grasp the basics of a Bank Guarantee. It is a written undertaking by a bank on behalf of its client, promising to honor a financial or performance-related obligation if the client fails to fulfill it. This financial instrument provides assurance to the beneficiary (the party receiving the guarantee) that they will receive payment or compensation in case of default.

Key Considerations When Choosing Bank Guarantee Providers:

As a leading trade finance solution provider, Pacific Corp recognizes the pivotal role bank guarantees play in fostering trust and mitigating risks in international business dealings. Here are the few key considerations for choosing the right BG provider for your trade business.

1.Reputation and Reliability:

Investigate the reputation of potential BG providers. Look for established institutions known for reliability and financial stability.

2.Experience in Trade Finance:

Choose providers with extensive experience in trade finance. Knowledge of international trade dynamics is crucial for effective bank guarantee services.

3.Global Presence:

Opt for providers with a global network. This ensures seamless transactions and support across different countries and regions.

4.Flexibility and Customization:

Assess the flexibility of terms and conditions offered by providers. Look for those willing to tailor bank guarantee solutions to your specific business needs.

5.Comprehensive Range of Guarantees:

Consider providers offering a variety of guarantees, such as performance guarantees, advance payment guarantees, and financial guarantees. This versatility caters to diverse business requirements.

6.Technology Integration:

Evaluate the technological capabilities of potential providers. Those leveraging digital platforms or advanced technologies offer enhanced efficiency and transparency.

7.Cost Structure:

Understand the cost structure associated with bank guarantee services. Consider not only the upfront fees but also ongoing maintenance costs and any additional charges.

8.Customer Support:

Prioritize providers offering excellent customer support. Responsive and knowledgeable support is crucial, especially during urgent or complex transactions.

Types of Bank Guarantees:

Bank Guarantees serve as versatile instruments, adapting to distinct scenarios in the business landscape. Understanding the nuances of these guarantees empowers businesses to choose the most suitable instrument based on their specific needs, mitigating risks and fostering confidence in various trade & financial dealings.

Performance Guarantee:

This type of bank guarantee acts as a safeguard in contractual agreements, assuring the project owner that the contractor will fulfill their obligations as outlined in the contract. If the contractor fails to meet the terms, the bank steps in to compensate the project owner, offering financial security and ensuring the smooth execution of the project.

Advance Payment Guarantee:

Advance Payment Guarantees are crucial in scenarios where a buyer makes an advance payment to a seller before the delivery of goods or services. This guarantee ensures that, in the event the seller fails to fulfill the agreed-upon terms, the bank will reimburse the buyer for the advanced payment. It adds a layer of security for the buyer, encouraging them to engage in transactions that involve upfront payments.

Financial Guarantee:

Providing confidence in financial transactions, a Financial Guarantee assures the repayment of a financial obligation. This type of guarantee is often used in various financial contexts, such as loans or investments. It acts as a commitment from the bank that, in case the party involved defaults on their financial obligation, the bank will step in to cover the specified amount. This assurance encourages financial transactions by mitigating the risk associated with non-repayment.

Tips for Choosing the Best BG Providers:

Selecting the right bank guarantee provider is crucial for a seamless and secure trade & financial arrangement. By carefully considering the following factors, you can choose a Bank Guarantee provider that not only meets your immediate needs but also establishes a reliable and supportive partnership for your future trade endeavors.

1.Industry Expertise:

Look for providers with expertise in your industry. Understanding the specific needs and challenges of your sector is crucial for tailored solutions.

2.References and Reviews:

Seek references and reviews from businesses that have previously utilized the services of the provider. Positive testimonials indicate reliability.

3.Legal Compliance:

Ensure that the provider adheres to international trade regulations and legal standards. Compliance is vital for a smooth and secure transaction process.

4.Scalability:

Choose providers capable of scaling their services according to your business growth. A scalable solution ensures long-term compatibility.

5.Transparent Communication:

Prioritize providers who communicate transparently about terms, conditions, and processes. Clear communication fosters trust and avoids misunderstandings.

6.Financial Strength:

Assess the financial strength and stability of the provider. A financially robust institution is more likely to fulfill its obligations.

Conclusion:

Choosing the best BG provider is a strategic decision that can significantly impact the success of your international trade ventures. By considering factors such as reputation, experience, global reach, and the variety of guarantees offered, you can make an informed choice that aligns with your business goals. Whether you’re a seasoned player in global trade or a newcomer, this ultimate guide equips you with the knowledge to navigate the complexities and choose the best bank guarantee provider for your business. Secure your transactions, mitigate risks, and foster confidence in your international trade endeavors.

Pacific Corp invites you to explore the possibilities and navigate the future of global trade with confidence. By aligning with a trusted partner, you not only secure financial transactions but also unlock the potential for success in the dynamic landscape of international business. Choose Pacific Corp for a journey that goes beyond transactions – a journey toward global success.

Get In Touch

Subscribe to Our Newsletter